Menu

Accounting shared services

Our team of professional accountants manages your accounting entirely, taking care of all accounting responsibilities including accounts receivables data entry for cash, card and invoiced payments, and accounts payables data entry for settlement of suppliers invoices.

In addition, the profit & loss statement, balance sheet and analytics reports are automatically emailed to SME owners every month.

In addition, the profit & loss statement, balance sheet and analytics reports are automatically emailed to SME owners every month.

Tax services

Our experienced team of certified tax specialists helps your food and beverage company meet legal compliance requirements. We improve GST efficiency and cashflow savings, monitor statutory deadlines to meet compliance filing deadlines, prepare and file estimated chargeable income, prepare and submit the finalised tax computation and Form C to IRAS, and advise on tax payment due dates upon receipt of the Notice of Assessment.

Human Resources shared services

SPRING Singapore has appointed Lee Wenyong & Co., the parent company of SME Survival, to offer SMEs shared access to HR systems, services and advisory services.

This enables SMEs to outsource all of their HR operational activities and leverage on IT to enhance their HR systems and processes. Lee Wenyong & Co. is appointed by SPRING Singapore as a pre-qualified HR shared service provider in the areas of:

1) providing outsourced HR operations services,

2) provision of HR advisory services, and

3) providing HR IT systems & administrative support.

SMEs can receive funding support of up to 70% of qualifying costs, including a one-time set up cost and monthly HR subscription cost capped at 12 months.

This enables SMEs to outsource all of their HR operational activities and leverage on IT to enhance their HR systems and processes. Lee Wenyong & Co. is appointed by SPRING Singapore as a pre-qualified HR shared service provider in the areas of:

1) providing outsourced HR operations services,

2) provision of HR advisory services, and

3) providing HR IT systems & administrative support.

SMEs can receive funding support of up to 70% of qualifying costs, including a one-time set up cost and monthly HR subscription cost capped at 12 months.

Sample financial reports

The following are samples of monthly financial reports SME owners receive via email when they sign up for forever free professional accounting services.

Click to download:

Click to download:

| profit_and_loss_by_month.pdf | |

| File Size: | 95 kb |

| File Type: | |

| profit_and_loss_year-to-date.pdf | |

| File Size: | 89 kb |

| File Type: | |

| balance_sheet_by_month.pdf | |

| File Size: | 90 kb |

| File Type: | |

| balance_sheet_year-to-date.pdf | |

| File Size: | 83 kb |

| File Type: | |

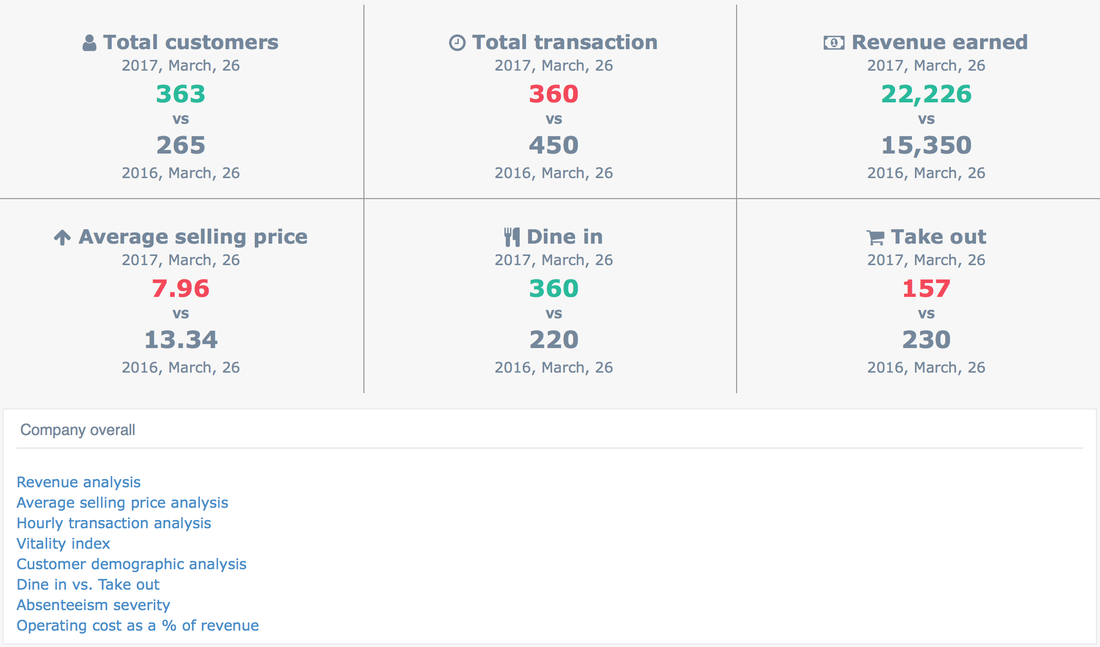

Financial analysis reports dashboard

In addition to the emailed financial reports, every SME owner is also granted access to their respective online analytics reports dashboard. All analytics reports can be viewed from a computer or from a mobile phone. These analytics reports are also automatically emailed to SME owners every month.

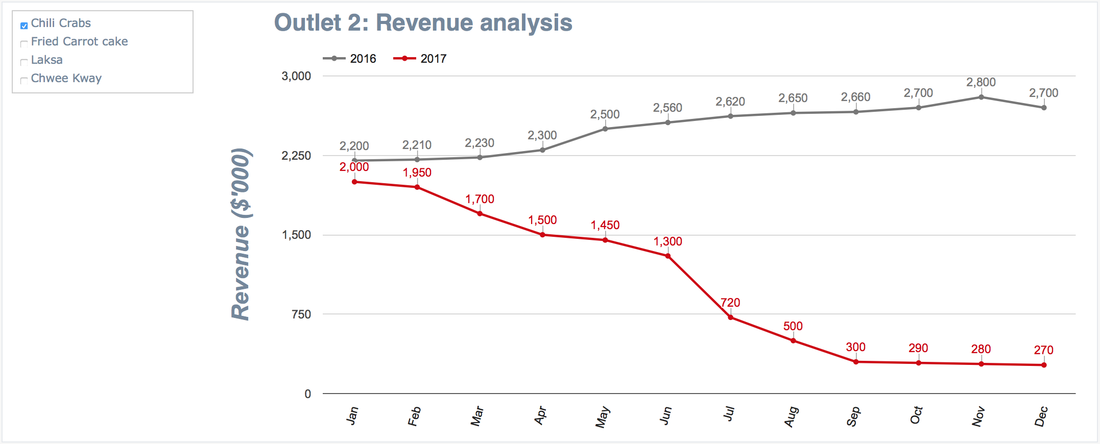

Revenue analysis

Revenue is recorded and reported for the year, and automatically compared to last year's sales trend.

Average selling price analysis

Average selling price is used to determine if customers are buying high or low value products / services.

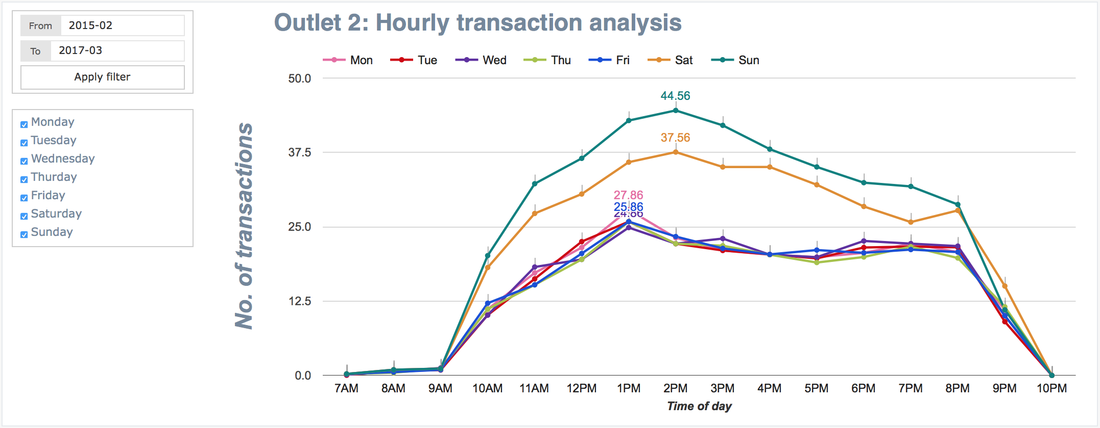

Hourly transaction analysis

Historical sales trends are analysed to assist with planning of operations duty shift roster.

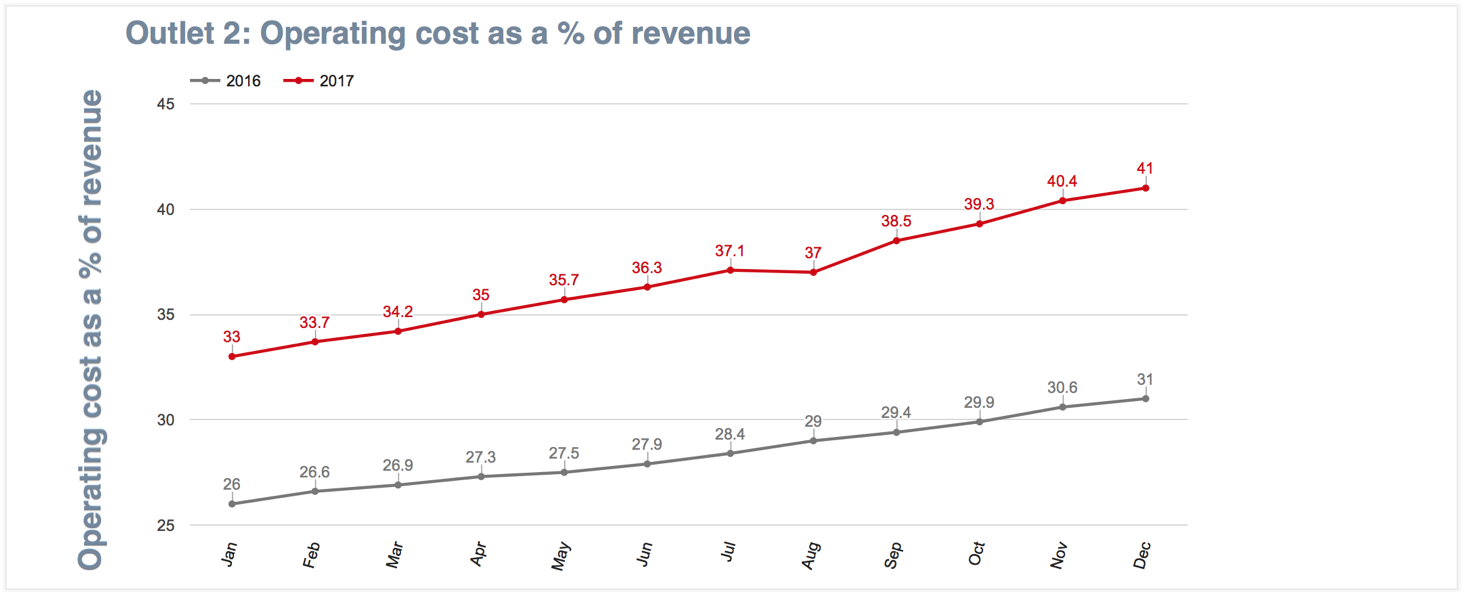

Operating cost as a % of revenue report

SME owners receive an automated email alert when cost exceeds a pre-set threshold.

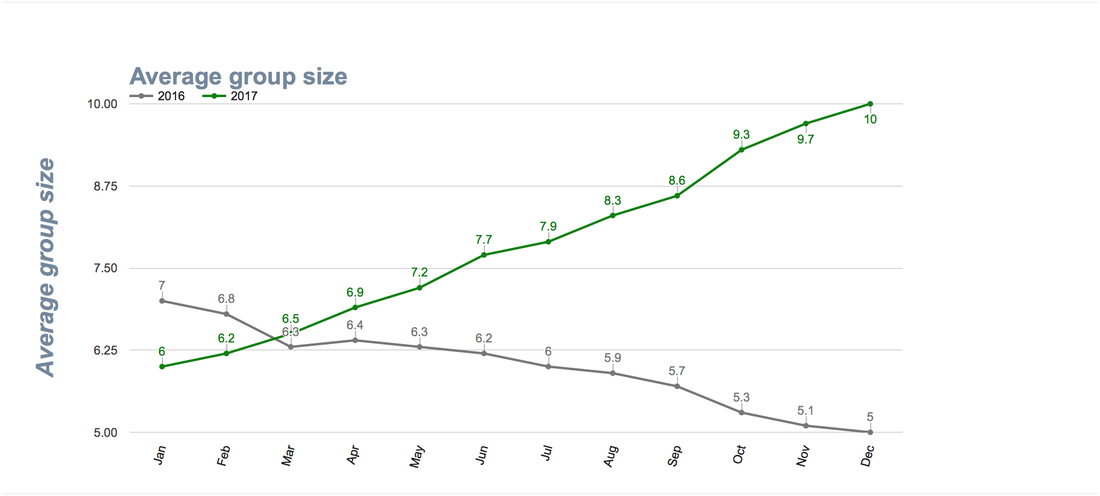

Customer demographic report: Average group size

Understand customers better by studying their consumption patterns.

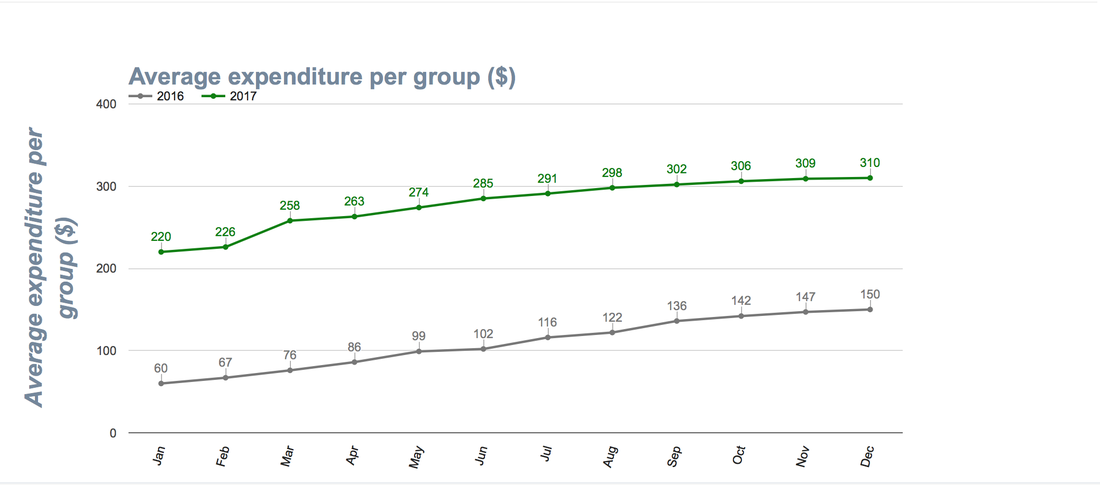

Customer demographic report: Average expenditure per group

Deep insight into customer buying behaviour allows SME owners to introduce relevant products / services.

Location |

|